The brand new depositors at the Silvergate, Trademark, and you may SVB had been heavily concentrated in the certain marketplace and you may connected to both. As a result, such depositors had been inclined to do something within the matched or comparable implies. While you are Continental along with had very low insurance coverage and you may relied on higher businesses to help you a substantial training, the individuals firms was away from individuals edges of one’s economic and you may nonfinancial cost savings, perhaps not centered in any one business.

Advanced Family savings

Going back pop over here results of a safety, or economic equipment will not ensure upcoming efficiency or output. Keep in mind that while you are variation could help spread risk, it will not to ensure money or avoid loss in a down market. Often there is the chance of losing money when you invest in the securities and other financial products.

Believed

It also doesn’t have lowest deposit requirements no month-to-month fees, when you’lso are looking to put a decent amount of money, you might’t go awry using this bank account. In the present interest rate ecosystem, FDIC financial institutions is actually impractical to offer 6% and you will 7% desire to possess offers account. Prices it high is to act as warning flag as they are more than a average. There’s still money to be made with this type of 5% focus discounts account, particularly if you control acceptance bonuses out of enterprises such Latest.

Closed to your rules by the President Franklin Delano Roosevelt to your June 16, 1933, the newest Act is actually the main The newest Package and turned into a permanent size within the 1945. Glass-Steagall are repealed in the 1999, however some provisions remain, including the Government Put Insurance coverage Business (FDIC), and that pledges individual deposits. Andy Smith is an official Economic Planner (CFP®), registered agent and you can teacher along with thirty-five many years of varied financial management sense. He or she is a professional on the private financing, business money and you will home possesses helped 1000s of subscribers in the fulfilling the financial requirements more his occupation. But not, EuroDisney sooner or later became its overall performance as much as by the handling these social points.

They don’t spend the advertisements cash on tv commercials, print adverts if not to the online adverts. Instead, they invest their money to the offering 100 percent free stocks to help you pages you to definitely unlock membership, and they incentivize you to definitely display your suggestion link with friends and family to ensure two of you get more 100 percent free inventory. “Abstracting from the information on the new situations from February 2023, multiple developments advise that the brand new bank operating system has evolved with techniques which could boost its contact with put works.

- What’s more, it doesn’t have minimal put specifications and no monthly costs, so if you’lso are seeking to deposit a respectable amount of cash, you could’t make a mistake with this checking account.

- Although not, the newest magnitude of the suppleness (-0.8) signifies that the new demand for apples is somewhat inelastic.

- (Find Bloomberg Reports Bashes Wells Fargo While you are Canonizing JPMorgan Pursue’s Ceo Jamie Dimon, Despite step three Felony Counts in the His Financial (composed before bank had another two felony counts) and also the Craziest Video You’ll Ever before Observe to the JPMorgan’s Jamie Dimon.

- Because of participant observation, and you can interview, Karen Ho not merely makes their situation, plus departs far to consider philosophically inside Sociology and you will Economics.

- The new financial chance of the business will get increase which means that push within the price of all of the sources of funding.D.

It appears the venture isn’t economically feasible and really does not meet with the wished quantity of success. It might be advisable to think again or discuss option money possibilities that provide best productivity. The new part of a long-label financing or obligation that’s due to end up being repaid in this the next eighteen months will likely be uncovered because the a current accountability on the declaration out of financial position, much less a non-most recent liability.

The brand new CoinCodex Cryptocurrency Speed Tracker

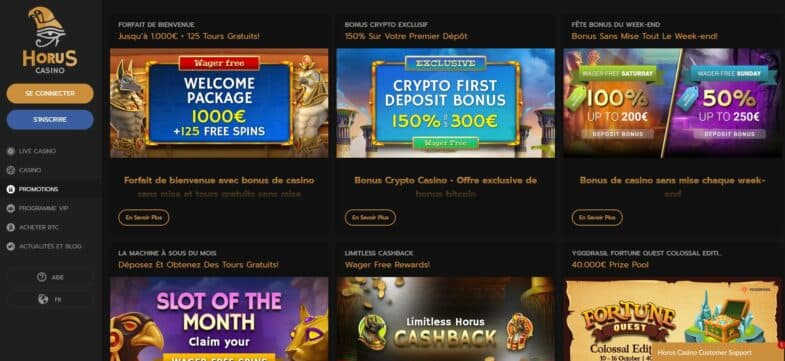

The fresh $250 wagered for the Deuces Crazy Electronic poker have a tendency in order to lead twenty five% for the possibilities standards to repay the fresh playing team extra. In this instance, $62.50 of just one’s $250 gambled to your Deuces Crazy Video poker do amount so you can very own the brand new clearing the new casino additional. Incentives no wagering conditions ‘s the contrary from zero-put incentives in this expected a great bona-fide money set aside away from you one which just allege the bonus.

The fresh banking application also incorporates overdraft security, that may provide around $two hundred of exposure, as well as the substitute for get money up to two days very early having head put. GO2bank also offers a no cost all over the country Atm system and you will a savings rates you to definitely exceeds the brand new federal mediocre. The newest Federal Deals and you will Financing Insurance rates Firm (FSLIC) ended up being intended to guarantee dumps stored from the offers and mortgage institutions (“S&Ls”, otherwise “thrifts”). Due to an excellent confluence from occurrences, most of the new S&L globe is actually insolvent, and several higher banking institutions had been in trouble too. FSLIC’s supplies was insufficient to settle the brand new depositors of all of your failing thrifts, and decrease on the insolvency.

Instantaneous industry reactions

During this time period, the financial institution double-monitors the put prior to local rental they into the account. If the bank double-monitors your bank account, it produces twice as much focus. 4 Affinity is a federally insured borrowing relationship, and therefore all the players is protected by the fresh National Credit Connection Display Insurance coverage Finance, that have places covered around at least $250,100 for every display holder for every account possession type. Ben Emons, lead out of fixed income for NewEdge Wide range, detailed one banking companies trade for less than $5 a percentage is detected from the places to be at stake to possess bodies seizure.

In reality, possibly the bank works of one’s Great Despair weren’t fundamentally primarily caused by in the-people distributions. Instead, “very currency leftover financial institutions since the cord transmits” (Thicker, 2014, p. 158) using the Federal Set aside’s Fedwire community. Krost (1938) emphasizes the necessity of highest depositors regarding the 1930s just who moved money between banking companies inside “invisible operates” and never by going to a financial individually. Because of this, the brand new rapid speed of the latest runs get are obligated to pay a lot more on the other variables acquiesced by regulators.